Help & Support - Online Services

Online-services

Online-services

When storing or destroying your personal information, we use strict security safeguards to prevent unauthorized access, collection, use, disclosure, copying, modification, disposal, or similar risks. If we need to transfer your personal information to a third party such as our service provider, TrueMotion, Inc., they're contractually required to protect and handle your personal information. This transfer is consistent with our privacy safeguarding measures and according to all applicable laws.

Registered drivers must drive at least 500 kilometres for their driving habits to be accurately assessed. The more you drive the more accurate picture of your driving habits we'll get and the more personalized your price will be.

If you don't drive the minimum kilometres, you will not be cancelled from Smarter ride. However, upon renewal the activation discount would fall off and you may not be provided with an Adjustment, or the impact of the Adjustment will be less significant. For more details, refer to the question “How do you personalize my price?”.

Your driving data is collected throughout your policy term until renewal, which allows us to adjust your premium. This could increase or decrease the cost of your car insurance and change your price when your policy is renewed.

For Alberta, Ontario, Quebec:

Your driving habits are used to adjust your premium based on the driving habits we record every time you drive. By driving safely, you could decrease the cost of your insurance by up to 25%, but risky driving could increase your premium by 25%.

Here's an example, for illustration purposes only, of a $1,000 yearly car insurance contract:

If you're a new customer to Scotia Home & Auto Insurance who signed up for Smarter ride, you will receive a one-time 10% activation discount, so your premium will be $ 900 for the year.

We will adjust this premium according to your driving habits when your insurance is renewed. The adjustment could vary between:

- a maximum decrease of 25% = $ 750 for the year

- a maximum increase of 25% = $ 1,250 for the year

For more details, refer to the question "How can I see how my driving affects the cost of my insurance?".

For Nova Scotia:

Three factors help determine the price of your insurance at renewal: standard factors (e.g. type of car, location), your driving context (e.g. how much you drive, where), and your driving style (e.g. speeding, using phone while driving, smoothness). Smarter ride adjusts your premium based on your driving habits, which are recorded every time you drive.

For example, a driver who has signed up with Smarter ride may earn a 15% discount based on the low risk associated to their safe driving habits. At renewal, their premium without Smarter ride might have been $1000 (calculated based on standard factors at the time of his renewal), but they received a renewal offer of $850 because they are using Smarter ride.

Another driver may earn a 15% surcharge based on their risky driving habits. At renewal, their premium without Smarter ride might have been $1000 (calculated based on standard factors at the time of this renewal), but they received a renewal offer of $1150 which reflects the greater risk their driving represents for themselves and other drivers. Please note that premium increases may be due to other factors besides Smarter ride.

Most of our Smarter ride customers save as opposed to having a premium based solely on standard factors. You can go to the “Personalized premium” section of your mobile app to view how your driving habits will impact your premium at your next renewal.

For Alberta, Ontario and Quebec:

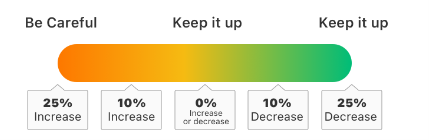

Go to the Smarter ride section of the Scotia Home & Auto Insurance App and check the "Make every trip count" feature once you receive your insurance renewal, or any time you want to check your progress:

- Far right of the green half of the gauge, you could see a decrease in premium between 10% and 25%.

- Middle of the gauge, your premium could fluctuate slightly up or down between 1% and 10%, or there could be no change (0%).

- Far left of the orange half of the gauge, you could see an increase in premium between 10% and 25%.

This is just an example of what your personalized premium Adjustment could be. Several factors are taken into account to calculate your premium other than your participation in Smarter ride, which increases or decreases when your insurance is renewed.

Check the App regularly to help improve your driving.

For Nova Scotia:

Go to the “Personalized premium” section of your mobile app to view how your driving habits will impact your premium.

This section is updated monthly based on your driving style and driving context. Keep checking the app regularly to see your progress and get tips on how to improve.

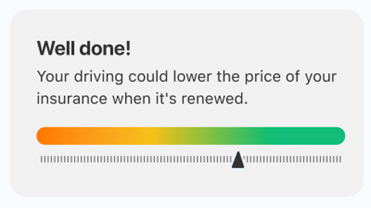

For example, a driver might see the following indicator in the “Personalized premium” section of their mobile app, indicating a trend towards a discount at renewal. They will have to maintain safe driving habits until their renewal to unlock a discount.

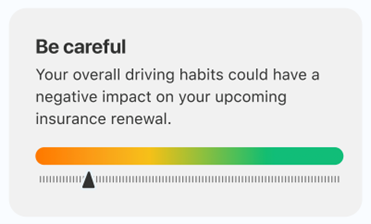

In another example, a driver might see the following indicator in the “Personalized premium” section of their mobile app, indicating a trend towards an increase at renewal. They may have the opportunity to lower the risk of their driving habits until their renewal date.

Your personalized premium will be applied to the following Scotia Home & Auto Insurance car insurance coverage (where applicable):

- Liability (Bodily Injury and Property Damage)

- Direct Compensation - Property Damage;

- Accident Benefits (Standard Benefits);

- Uninsured Automobile;

- Collision or Upset;

- Comprehensive;

- All Perils;

- Specified Perils.

Refer to your insurance documents for more details on the coverage listed above.

You will remain registered for Smarter ride even if your car is in storage. If you drive another car, your driving data will continue to be collected. If you don't drive during this time, the App will assess your driving habits once you start driving again. According to our Terms of Use, previously collected driving data may be used to calculate your premium adjustment.

Refer to the question "What happens if I delete the Scotia Home & Auto Insurance App " if you uninstalled the App.

If you cancel your Smarter ride enrollment, you will no longer be able to access the Smarter ride section in the App. Check your car insurance policy to see if your driving habits are still being used to adjust your price. If there's no mention of Smarter ride in your policy, then you're no longer registered, and your driving data is not being used to personalize your premium.

Consult your quarterly Smarter ride email or contact us if you want to know if the premium of your car insurance will increase or decrease because of your previously collected driving data. You can join again if you still meet Smarter ride 's eligibility criteria by contacting us at 1-833-460-8162.